“Grow your Business With GST Registration Services in Delhi”

“We are committed to Serve you Best GST Registration & Consultant Services in Delhi. You can explore and learn more about the services on our Page. we Believe to provide you the Best Services on Time and get to know our team of dedicated professionals who will take care of your needs.”

Phone

+91-9971922508

hello@allservicesprovider.com

Office

T-72/D, Indira Colony, Narela, Delhi-110040

Hours

Monday-Saturday:

9am – 6pm

Choose Your GST Related Services Requirements.

“Drop Your Query Related GST Registration Services.”

Bringing All Your Service Needs Under One Roof

GST Registration

We excel in ensuring your home gleams and remains pest-free with our professional house pest control services.

Company Registration

We are experts in termite management, ensuring a clean and pleasant environment for both.

FSSAI Registration

We excel in bed bug treatment, complemented by our professional facade pest control services.

ISO Certification

We ensure that every part of the home is meticulously cleaned and made safe for our well-being.

Annual Return Filing

“We are experts in cockroach control, ensuring your property remains pristine and fresh.”

GST Filing

We ensure a spotless and hygienic environment for a delightful dining experience.

Trademark Registration

We specialize in restoring the natural shine of marble surfaces through expert polishing techniques.

NGO/TRUST Registration

We are dedicated to promoting sustainability and environmental responsibility through our green services.

Why Should You Pick Us?

EXPERTISE TEAM

Mastery in a specific field,

demonstrating deep knowledge skills.

CUSTOMISED SOLUTIONS

Tailored Answers Designed to meet

Unique Needs & solve Specific Challenges.

COST EFFECTIVE

Efficient spending, delivering value without

excessive expenses or waste of resources.

RELIABILITY

Consistent performance, trustworthiness,

and dependability in all circumstances

and tasks.

CUSTOMER-CENTRICITY

Prioritizing customer needs, satisfaction,

and feedback at the core of operations.

SCALABILITY

Adaptability to growth, easily expanding or

contracting as demands change efficiently.

CUTTIING-EDGE TECHNOLOGY

Utilizing the latest advancements to stay

ahead in innovation and development.

COMPREHENSIVE SERVICES

Complete offerings addressing diverse

needs with thoroughness and attention

to detail.

TRANSPARENT COMMUNICATION

Clear and honest exchange of information,

fostering trust and understanding.

- GST Registration Services in Delhi

- What Choose Professionals for GST Registration Services

- Why Choose All Service Providers Team

- Summarise the significance of deep cleaning services in maintaining a healthy and clean environment in Delhi.

- Encourage readers to consider hiring professionals for their deep cleaning needs.

- Provide contact details for deep cleaning services in Delhi or a directory of reputable cleaning companies.

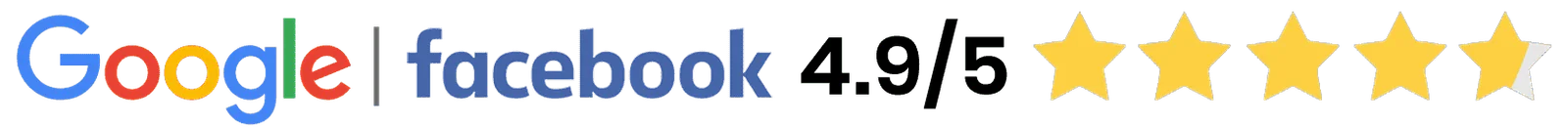

The Goods and Services Tax (GST) is a type of tax in India that applies to most things you buy or services you use. It’s a tax that gets paid where you use the goods or services, not where they are made. If your business makes more than a certain amount of money, you have to register for GST. But even if your business makes less money, you still need to register if you do things like selling to other states, importing or exporting goods, or offering online services.

BENEFITS OF GST REGISTRATION

Registering for GST has several advantages, such as

1 Legitimacy and Trust:

When a business is GST registered, it appears more trustworthy to customers and suppliers.

2 Tax Savings: Registered businesses can get back the GST they paid on their purchases, which lowers their overall tax bill.

3 Convenient Tax Compliance: GST registration simplifies following tax rules; businesses can file returns and pay taxes online.

4 Expanding Markets: With GST registration, businesses can sell to customers in other states without needing separate VAT registration for each state.

5 Government Perks: GST-registered businesses become eligible for government perks like subsidies and tax exemptions.

WHY GST REGISTRATION IS IMPORTANT.

GST registration is crucial for businesses, helping them save money, avoid penalties, access new markets, and expand their

operations.”Getting registered for GST is vital for businesses, and here’s why:

- To get money back: GST registration lets businesses reclaim the GST they paid on purchases, reducing their taxes.

- Avoid fines: If you’re required to register for GST but don’t, you can face penalties.

- Access government benefits:

Many government programs are only open to GST-registered businesses.

- Expand your business: GST registration helps companies grow and 4 without dealing with multiple taxes.

- Gain customer trust: GST registration shows your business is trustworthy, making customers more likely to choose you.

DOCUMENTS REQUIRED FOR GST REGISTRATION IN DELHI.

- PAN Card of the proprietor

- Aadhaar Card of the proprietor

- Passport size photograph of the proprietor

- Proof of business address (any one of the following)

1 Electricity bill

2 Water bill

3 Landline telephone bill

4 Bank statement

5 Rent agreement

- Proof of identity and address of authorized signatory (if applicable) Business Entity (Company/LLP/Partnership)

- PAN Card of the entity

- Certificate of Incorporation/LLP Agreement/Partnership Deed

- Memorandum of Association (MOA) and Articles of Association (AOA) (for companies)

- Passport size photographs of all directors/partners

Additional Documents Required

- Digital Signature Certificate (DSC) (optional but recommended)

- Bank account details of the business

- Audited financial statements (for companies with turnover of more than ₹20 crores)

NOTE: Please make sure to sign each document yourself and save them in PDF format. You can upload them online when you register for GST.

Steps to Register for GST in Delhi

- Go to the GST Portal and make your own account.

- Complete the online application form and attach the documents they need.

- Send the application and pay the registration fee.

- When your application gets accepted, you’ll get your GST registration certificate.

TYPES OF GST REGISTRATION IN DELHI.

GST registration is mandatory for all businesses In Delhi, if a business makes over Rs. 40 lakh a year (or Rs. 20 lakh in special category states), it must register for GST. The type of GST registration you need in Delhi depends on your business’s type and what it does.

1 NORMAL REGISTRATION

Normal registration is the usual type of GST registration. It’s required for all businesses that need to pay GST on what they sell. With normal registration, businesses can get benefits like tax credits and avoid paying tax twice.

2 COMPOSITION REGISTRATION

Composition registration is a simpler way to register for GST and is for small businesses making less than Rs. 1.5 crore a year (or Rs. 75 lakh in special category states). These businesses don’t need to do complex GST paperwork. Instead, they pay a set percentage of their sales as GST.

3 NON-RESIDENT TAXPAYER REGISTRATION.

Non-resident taxpayer registration is for businesses outside of India that sell taxable goods and services in Delhi. If these businesses are selling goods and services to registered taxpayers in Delhi from another state, they must get this registration.

4 CASUAL TAXPAYER REGISTRATION.

Casual taxpayer registration is for businesses that only sell taxable goods and services in Delhi temporarily or from time to time. This registration lasts for three months and can be extended for another three months if needed.

5 E-COMMERCE OPERATOR (ECO) REGISTRATION.

If you run an e-commerce marketplace, you can get E-commerce operator (ECO) registration. ECOs must gather and send in TCS for certain sales that happen on their platform.

6 TAX DEDUCTED AT SOURCE (TDS) REGISTRATION.

If your business needs to deduct tax from certain payments you make, you can get Tax Deducted at Source (TDS) registration. TDS is a way to collect tax from the person paying the income, not the one receiving it.

7 TAX COLLECTED AT SOURCE (TCS) REGISTRATION.

If your business needs to collect tax from certain payments you receive, you can get Tax Collected at Source (TCS) registration. TCS is a way to collect tax from the person receiving the income, not the one making the payment.

Who needs to register for GST in Delhi?

Goods and Services Tax (GST) is a tax on things you buy and services you use in India. Some businesses and people must register for GST, but it’s a choice for others.

The following persons are required to register for GST in Delhi:

- If a person’s total sales go over Rs. 40 lakhs in a year (or Rs. 10 lakhs in North-Eastern states and Union Territories), then certain rules apply.

- In simple terms, anyone who offers taxable services, regardless of how much they make, has certain responsibilities.

- Anyone who brings in or sends out goods, whether they’re a big or small business, has certain obligations.

- Anyone who has to take out tax from GST payments has certain responsibilities.

- Anyone who must gather tax from GST payments has specific duties.

- Any person who isn’t a resident but has to pay taxes has certain requirements to follow.

Exemptions from GST registration

- People who sell items or services that don’t have GST taxes or are completely tax-free have specific rules to follow.

- Farmers, when they sell what they grow on their land, are exempt from certain taxes.

- This refers to independent lawyers, including experienced ones.

- This includes individuals who offer sponsorship services, which can even include athletes themselves.

Penalties for non-registration

- If someone needs to register for GST but doesn’t, they might have to pay a penalty, which can be as much as 10% of the tax they owe.

- If you’re not sure if you should register for GST in Delhi, it’s a good idea to talk to a tax expert for guidance.

HOW TO CHOOSE THE RIGHT GST REGISTRATION CONSULTANT.

Picking a consultant for your GST registration can be tough, especially if you’re new to the GST system. A good consultant can guide you from understanding GST rules to finishing the registration process and following the rules. But with so many consultants out there, it’s hard to know where to begin.

⚫ Here are some tips on how to pick a GST registration consultant:

1 ASK FOR REFERRAL

A great way to find a good consultant is to ask friends, family, or business contacts who have recently registered for GST. They can share their experience with the consultant they used.

2 Ask for a written price estimate.

Before you hire a consultant, make sure to get a written price estimate. This will prevent unexpected costs later on. The estimate should clearly state what services you’ll get and how much you’ll be charged.

3 Look at the consultant’s qualifications.

When you have a few consultants in mind, make sure to check their qualifications. This means confirming their professional background, experience, and any certifications they have. You can do this by visiting the consultant’s website or getting in touch with the appropriate professional organizations.

4 Inquire about the consultant’s experience working with businesses in your specific field.

Picking a consultant with experience in your industry is crucial. It means they know the GST rules that apply to your business.

5 Ensure that the consultant is good at communicating.

When picking a consultant, it’s vital to find someone who answers quickly and talks well. You should easily get in touch with them for questions or worries.

ADDITIONAL TIPS

When you meet with the consultant, ask them lots of questions about how the GST registration works and what your business needs. Make sure they can explain the GST rules clearly. Pick a consultant who’s ready to keep helping and guiding you even after you’re registered for GST.

Fees are charged by GST registration consultants in Delhi.

GST registration consultants in Delhi usually charge between Rs. 1,200 and Rs. 5,000 for simple registration help. But if your business is more complex or needs extra services, the cost might be higher.

Things that impact how much you pay a GST registration consultant in Delhi.

Many things can change how much GST registration consultants in Delhi charge, like these:

- How big and complicated your business is: If it’s big and complicated, the consultant might need more time and that can make the cost higher.

- How many GSTINs you need: If your business needs more than one because of what it does and where it operates, you’ll have to pay for each one separately.

- What kind of help you need: Some businesses just need help with registration, but others might want assistance with things like doing their returns and keeping records. If you need more complicated help, it can cost more.

GST RETURN FILING

In India, businesses registered under GST must do GST return filing. This means they have to give a detailed report about what they sold and bought, and the taxes they paid and collected. This helps the government check if they’re paying the right taxes.

Businesses file different types of GST returns based on their size and what they do. The most common one is GSTR-1, where all regular taxpayers list what they sold.

What are the different types of GST returns?

There are five main types of GST returns:

GSTR-1: Every registered business needs to do this every month. It’s like a report card showing what they sold and bought that had taxes.

GSTR-3: All registered businesses do this every three months. It’s like double-checking the taxes they paid or need to pay, matching what they told in GSTR-1 and GSTR-2.

GSTR-4: People who get a special type of GST deal do this every three months. It’s like a report card showing what they sold with taxes.

GSTR-5: People from outside the country who pay GST here do this every month. It’s like a report card showing what they sold and bought with taxes.

GSTR-6: People who give out services and help others with taxes do this every month. It’s like a report card showing what services they provided with taxes.

When do you have to finish filing GST returns?

It depends on the type of return. Here are the deadlines:

GSTR-1: By the 10th of the next month

GSTR-3: By the 20th of the next month

GSTR-4: By the 31st of the next month

GSTR-5: By the 20th of the next month

GSTR-6: By the 15th of the next month

What happens if you don’t file GST returns?

If you’re late with your GST returns, here’s what can happen:

- You might pay Rs. 100 for each day you’re late with GSTR-1 and GSTR-3.

- There could be an 18% yearly interest on the tax you owe.

- You might pay a penalty of 10% of the tax, but at least Rs. 5,000.

How can I file GST returns?

You can send in your GST returns online on the GST portal. Or, businesses can use authorized GST service providers to help with the process. Filing GST returns might seem scary, but it’s not hard when you follow simple steps. Here’s a step-by-step guide on how to do it online:

- Step 1: Get a GSTIN

If you haven’t done it yet, you need to get a special 15-digit number (GSTIN) that shows your business is part of the GST. You can do this online on the GSTN portal.

- Step 2: Collect Your Papers

Before you fill out your returns, make sure you have all your important papers ready. This means your sales receipts, bills for things you bought, and any other papers that show your GST transactions.

- Step 3: Sign In to the GST Website

When your papers are set, you can sign in to the GST website using your GSTIN and password.

- Step 5: Pick Your Return Type

You might need to pick a specific kind of GST return based on what kind of business you have and how much you make. The most usual ones are GSTR-1 (normal return) and GSTR-3B (summary return).

- Step 6: Pick the Time Frame

Select the time you want to report in your return. For instance, if you’re doing your report for July to September, you’d choose ‘July-September’ from the options.

- Step 7: Press ‘Get Ready Online’

After you’ve chosen your return type and time frame, press the ‘Get Ready Online’ button. This will get you to the page where you can fill out your return.

- Step 8: Put in Your Transaction Info

On the page where you’re preparing your return, type in all the info about your GST transactions for the time you picked. This means you write down what you sold, and bought, and your input tax credit (ITC).

- Step 9: Check and Send Your Report

After you’ve filled in all the needed info, go through your report to make sure it’s all right. If everything looks good, you can send in your report.

- Step 10: Pay What You Owe

If you owe any GST after taking away your input tax credit, you’ll have to pay it using the GST website.

More Tips for Filing GST Returns:

1- Keep your business papers neat and easy to find.

2- Send your returns in on time to avoid extra charges.

3-Get expert help if you’re unsure about any part of the GST return filing.

List of GST registration consultants in Delhi

Who is ASP ?

They offer seamless GST registration and return filing services in Delhi. Their team of experts will help you navigate around all accounting-related concerns and provide you with the best advice possible. They also offer affordable pricing and hassle-free migration facilities.We offer a professional and affordable GST registration service in Delhi. Their team of experts is known for their GST knowledge, and They focus on meeting their clients’ needs. They provide clear and practical solutions for all your GST requirements. They are a one-stop solution for businesses of all sizes, helping many clients save money and time. ASP is a top-notch service in Delhi for GST registration and account management. They provide excellent service at a fair cost. They offer legitimate advice to help you save money on taxes, serving as your one-stop solution for all GST and tax needs.

Why Choose ASP?

- Simple and easy-to-use platform

- Affordable pricing

- Hassle-free migration and registration

- Expert advice and support

- Great customer service

- Professional team

- Superfast services

- Great customer reviews

- Budget-friendly fees

- reliable

- professionalism

- Quick responses

Their Other Services

-

BUSINESS REGISTRATION

-

INCOME TAX RETURN (ITR)

-

ESI & PF REGISTRATION / RETURN

-

TRADEMARK REGISTRATION

-

IMPORT EXPORT CODE (IEC)

- Income tax filing

- Business tax planning

- Gst Compliance

- Tax Advisor

- Individual income tax return preparation

- Business loans

- Tax planning

- Company Registration

- Income Tax Returns

- Tax Audits

- Gst Compliance

Our Other Services

House Pest Control services

CCTV Camera Installation

MenPower Services

Security Staff Services

Interior Design Services

AC Repair & Service

Logistics Services

Fire Extinguisher Services

Tent Decorator & Wedding Planner

Education Guide

Tempo Traveller Booking Services

Deep Cleaning Services

GST Registration Services

Insurance Services

Instant Loan Solution Services

Digital Marketing Services

VASTU Consultants Services

UPVC Doors & Frames Installation Services

Website Designing Services

Others

F.A.Q.

Common Questions

WHAT ARE THE WARNING SIGNS OF A PEST INFESTATION?

Depending on the number of bugs present and the level of severity of the infestation, it can take many days or even weeks to eliminate a pest infestation. In tiny apartments, this might demand two or more days of treatment. However, in larger homes, the process gets completed in just one day.

ARE THERE ADDITIONAL BENEFITS TO HIRING ASP?

Yes Of course! After pest control, your house becomes completely clean. Your health will never be put at risk, and your food will never be endangered. after bed bug control.

HOW DOES PEST CONTROL WORK?

Depending on the number of bugs present and the severity of the infestation, it can take many days or even weeks to completely eliminate a pest infestation. In tiny flats, this might require two or more days of treatment. However, in larger residences, the process may be finished in just one day.

ARE THERE ANY ADVANTAGES TO PEST CONTROL?

Yes! You are going to profit from pest control in a variety of ways. ASP will always give you the best work because Our team members have particular skills.

HOW LONG WILL IT TAKE TO COMPLETE THE TASK?

We will complete the work as soon as possible to implement it. Our workers have delivered the work to their customers as quickly as possible. Further It Depends on Area Which is Needed to be Cover.

HOW LONG MIGHT IT TAKE YOU TO GET BACK TO MY HOUSE?

We will do everything important to get you your house ASAP. We go for all of the insects in every corner of the house and remove them until there is nothing left.

CHOOSING ASP TO PEST CONTROL SERVICES?

In Delhi, there are many providers who provide pest control services. But you have to get only the best quality service. ASP (ALL SERVICE PROVIDER) We provide you with safe control service, our Professionals have many techniques and ASP use quality types of equipment that can help work safely we provide you safe control service, our professional have many techniques work and ASP use the quality equipment they can help to work safely

HOW MANY TYPES OF PEST CONTROL SERVICE ASP PROVIDES?

There are a number of pest control services available, each targeting a different bug and utilizing a different strategy. Insect control, rodent control, pest control, and wildlife management are some of the common types.

HOW CAN WE BOOK ASP PEST CONTROL SERVICES?

You go to ASP’s website, enter your city’s PIN, and then choose what kind of service you require for your property from the menu. After submitting an online form, you can then decide whether to book now or call.